Company 2 will record the sale as due. Free Trial - Track Sales Expenses Manage Inventory Prepare Taxes More.

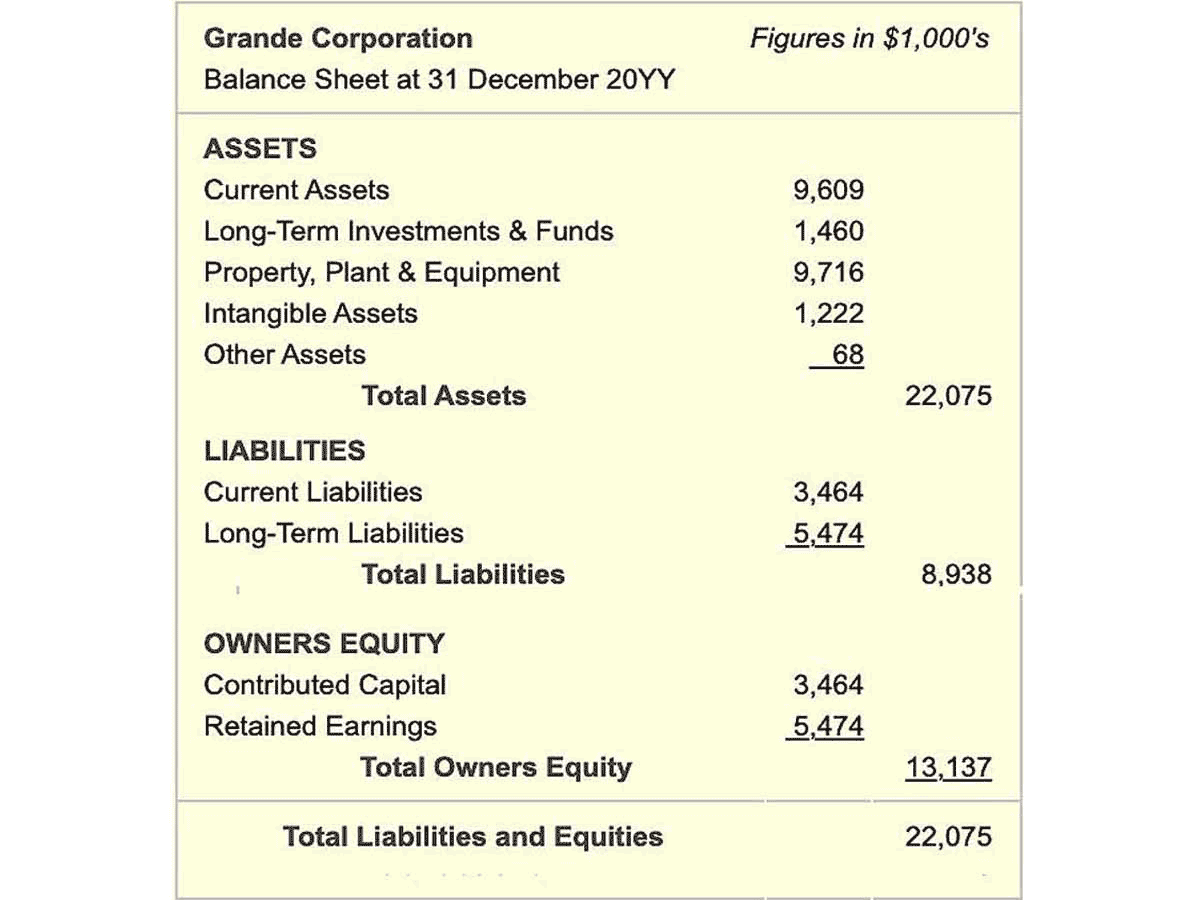

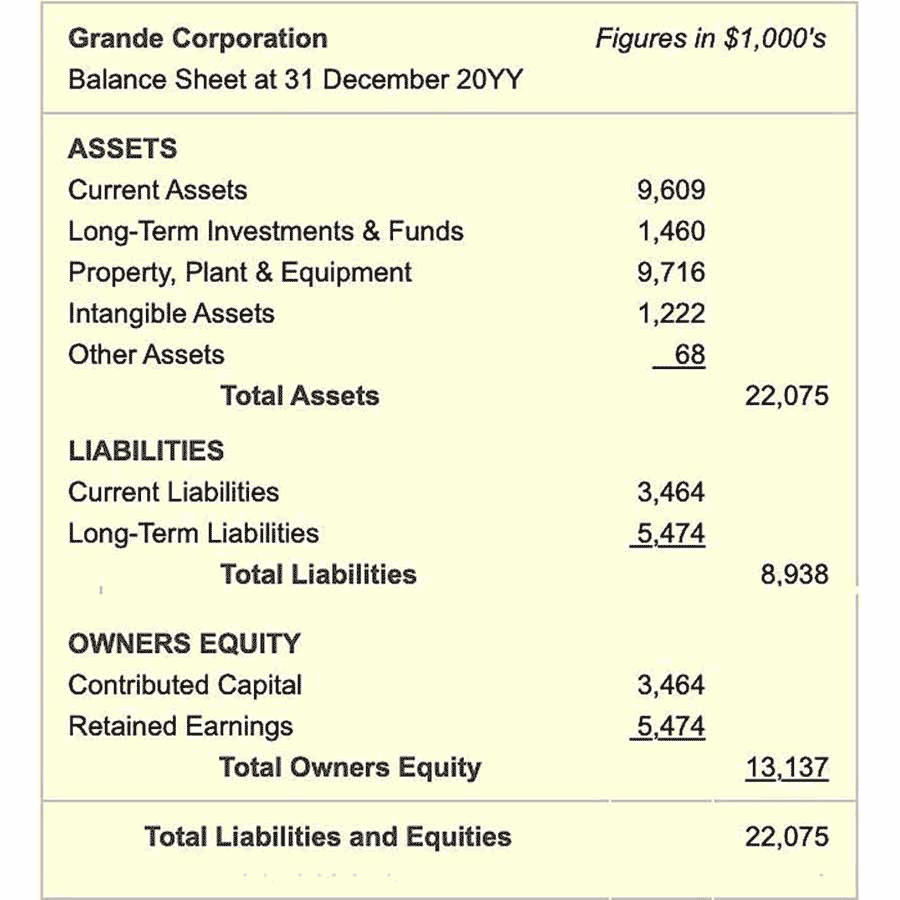

Owners Equity Net Worth And Balance Sheet Book Value Explained

A due from account is an asset account in the general ledger that indicates the amount of deposits currently held at another company.

. On Company ABCs Balance Sheet the Total Assets are 100000 while the Total Liabilities are 40000. The DL is paid back within 9 months after financial year end. - Line 1 chose Directors Loan account and entered the loan amount.

AMOUNT OWING TO DIRECTOR NOTE 11- AMOUNT OWING TO DIRECTOR. The amount needs to be paid back in 15 days. I have one issue about the Dirctor Loan.

Amount owing to or. Such directors will be liable to a fine of up to 20000 or imprisonment for up to 2 years. Company 1 purchases goods from Company 2 on account credit.

Ad 1 Create Free Balance Sheet In Minutes 2 Print Export Instantly - 100 Free. Cash in cash out. Avoid Errors Create Your Balance Sheet.

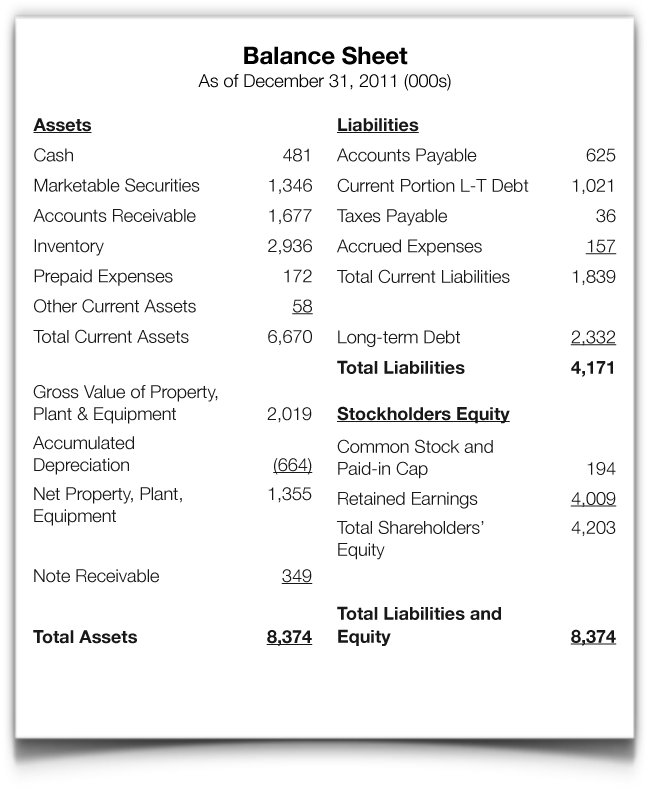

Balance sheet - amount due from directors. The Due from Shareholder receivable account may be paid within one year or it could carry a balance for a significantly longer amount of time. In this case the difference between the assets and liabilities is 60000.

Over 1M Forms Created - Try 100 Free. Over 1M Forms Created - Try 100 Free. Some years ago companies used to lend money to their directors and just before the year end the directors would use bank borrowings to pay off the loan and reborrow it in.

When the shareholder pays. Ad Create Free Balance Sheet In Minutes Print Export Instantly - 100 Free. Over 1M Forms Created - Try 100 Free.

Amount Owing means at any time all amounts the Buyer owes to the Seller under the Terms or if the context requires for specific Goods. Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Due From Account.

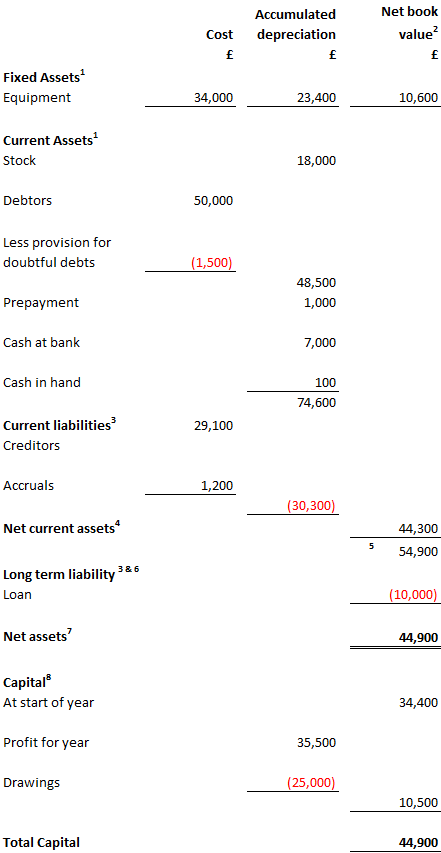

Avoid Errors Create Your Balance Sheet. Amount Owing means when Part B does not apply all. To my surprise the other accountant had recognised a 15k directors loan as a type of equity in this companies balance sheet.

And the amount of the loan or the extent of the guarantee or security. I took a loan of. Loans by directors to the company on the other hand do not generally need to be disclosed though in many circumstances it may help if they are.

Firstly if a balance remains outstanding on their loan account at the companys. Amount Owing To Director. The DLA is a combination of cash in money owed to and cash out money owed from the director.

22 Sep 2008 1 what does this item represent in a balance sheet. Ad 1 Create Free Balance Sheet In Minutes 2 Print Export Instantly - 100 Free. I am filing my company accounts LTD Micor Entity.

This seems madness to me. The debtor if money is owed. Avoid Errors Create Your Balance Sheet.

The director may loan the company 1000 to pay a.

How To Calculate Total Assets Definition Examples

Understanding Company Accounts Corporate Watch

What Is Shareholders Equity Bdc Ca

Understanding Company Accounts Corporate Watch

Balance Sheet Provides Insights For Debt Collection

Balance Sheet Example The Law Student Blog

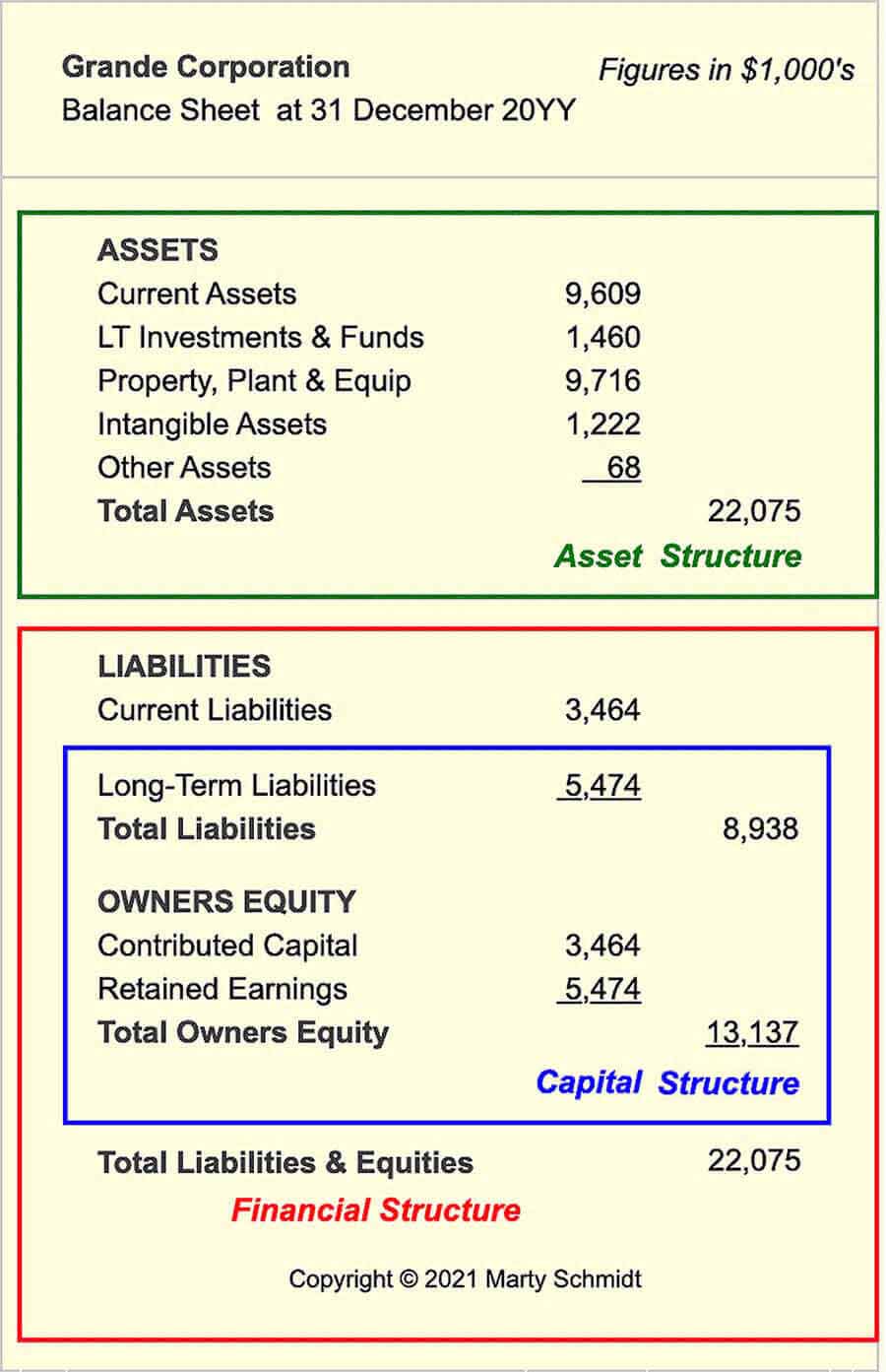

How Balance Sheet Structure Content Reveal Financial Position

Common Size Balance Sheet Double Entry Bookkeeping

How Balance Sheet Structure Content Reveal Financial Position

The Balance Sheet A How To Guide For Businesses

Balance Sheet Explained Maslins Accountants Maslins Accountants

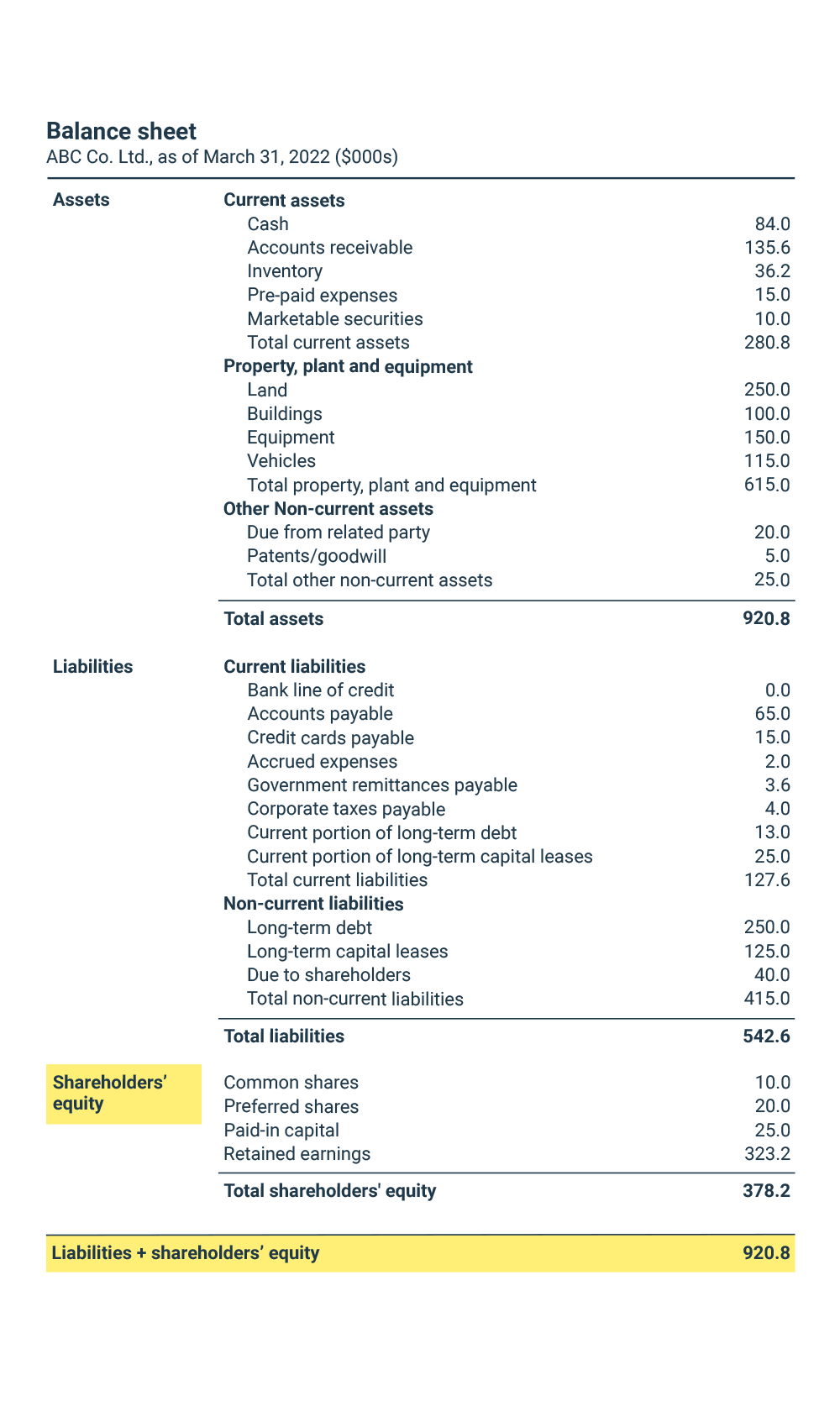

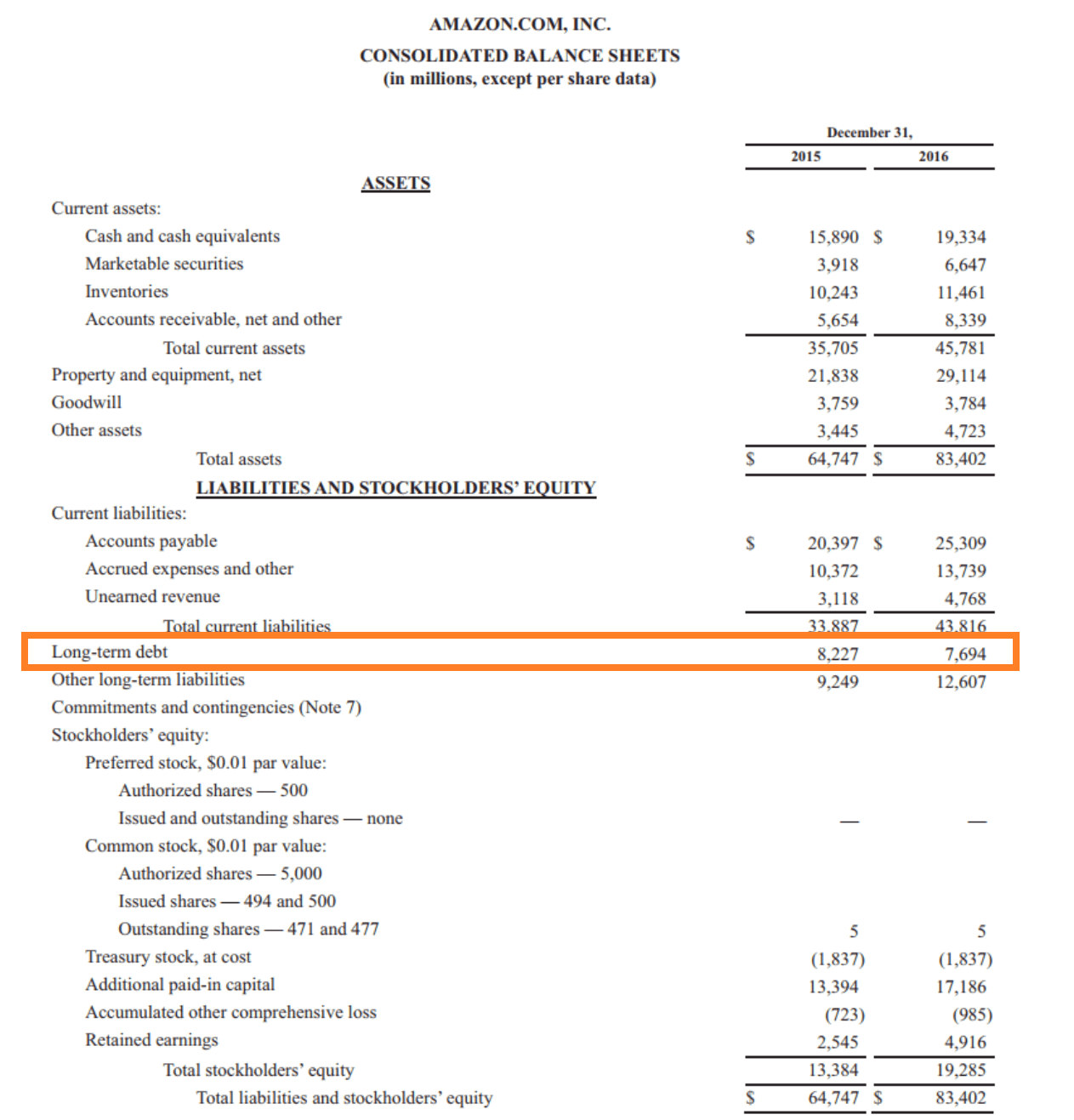

What Is The Current Portion Of Long Term Debt Bdc Ca

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

Balance Sheet Explanation Components And Examples

Balance Sheet Mba Knowledge Base

Balance Sheet Ratios Types Formula Example Accountinguide

The Balance Sheet A How To Guide For Businesses

Long Term Debt Definition Guide How To Model Ltd

:max_bytes(150000):strip_icc()/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)